With the exception of some really bad services that were absolutely begging for it like SubPals or Outride Social, I typically try to avoid blog posts that are overtly critical of any person or company.

"If you can't say anything nice, say nothing," my mom always said...

In the case of the popular e-commerce lending service Payability, however, I think it's time for some unbiased, critical feedback.

The reviews on sites like TrustPilot and from influencers simply do not match the horror stories from the Amazon seller community.

In full disclosure, I have not used Payability in my own business. I haven't lost money with them. There was no ugly fall out that led me to seek out a vendetta against them.

This article is based around feedback from sellers who claim to have been users and my deep follow-up research on Payability and the claims made against them.

My goal isn't to convince you to never use Payability or join me in picketing outside their corporate offices. I'm merely writing to give you the other side of the Payability story, the side that isn't blurred by affiliate hype and review suppression and manipulation.

Let's get into it.

What Is Payability

If you're reading this, it's highly likely that you know at least a little bit about the service already. But, just so we're all on the same page, here is Payability in a nutshell.

Quick Note

Payability has services not only for Amazon FBA but also sellers who use Shopify, Walmart, or NewEgg. In this article, we're only discussing how Payability works for Amazon sellers.

The two services that Payability offers to Amazon sellers are called "Instant Access" and "Instant Advance."

Instant Access allows sellers who would typically have to wait 2 weeks for their payouts the ability to receive daily payments instead. These payouts are 80% of their scheduled payout. The remaining 20% is paid out on the normal payout schedule (for example, every other Thursday), and the fees are subtracted from that amount.

This service is helpful for newer sellers, since most long time sellers are grandfathered into daily payouts and don't have to wait so long.

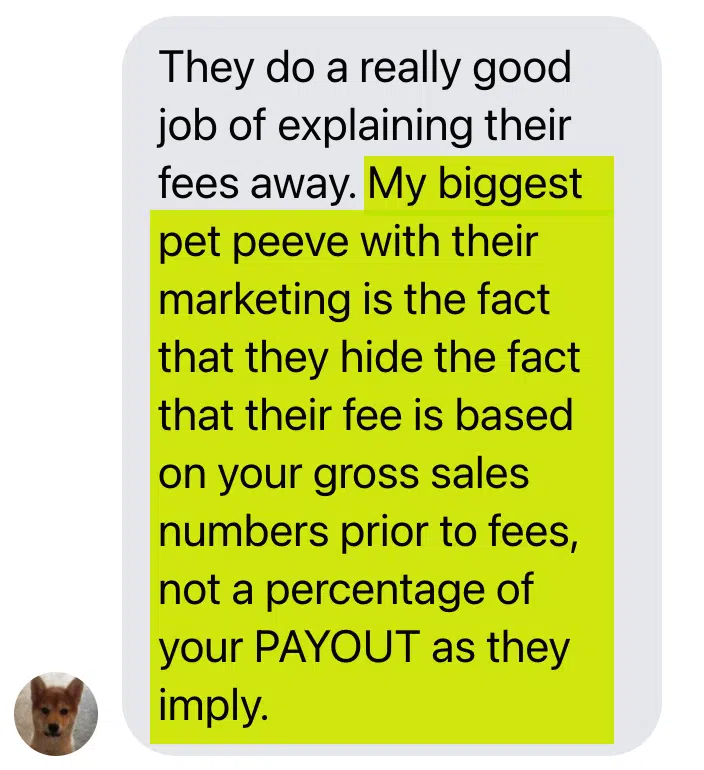

The fees range between 1% and 2% of your gross sales. More often than not, it seems the fee is closer to the 2% than the 1%.

This is the amount before any Amazon fees, refunds, or chargebacks, NOT a percentage of the actual payout.

To qualify for the Instant Access program, Amazon sellers need a minimum of 3 months sales history and $2,000+/month in sales revenue to be approved. Approval takes around 24 hours (which is crazy to me).

The allurement to this is clear: Access your capital more quickly, so you can reinvest it sooner. As long as the extra profits you can generate with this cashflow are greater than the fees, you're winning.

It's pretty straightforward, and the concept is business 101 level stuff.

The second service, Instant Advance, is a loan, and we won't cover it quite as much. It's a little more straightforward. It allows sellers to receive up to $250,000 to use on inventory or other business related expenses.

To qualify, you need 9 months of sales history and average $10,000+/month in sales on Amazon.

On paper, these are both amazing service concepts that every seller would be interested in.

There are several appealing hooks to these as

- No origination fees

- No annual fees

- No application fees

- No credit checks

- No early payoff penalties

So far, these services might be looking pretty enticing. Unfortunately, the terms of their services were the issue that threw a big wrench in things.

The Facebook Post That Tipped the Scales

Earlier this year, a member of my Facebook group FBA Today asked this...

Now, in fairness to Payability, the nature of this question (asking for cons not general reviews) will inevitably lead to more negativity than positivity.

However, the negativity spoke for itself. The sentiments expressed in this thread simply weren't represented as often anywhere else online.

Of the 91 comments (at the time of this writing) 31 were negative, 4 were positive, and the rest were just neutral or based on hearsay rather than personal experience.

If you want to view the original post and comment, you can click here.

This was wild to me because TrustPilot.com shows only 14 reviews of 1 star.

The Biggest Complaints of Payability

Broad claims like "they're a scam," don't cut it here. When researching Payability, I was looking for real-world examples of exactly what went wrong, so we could decide for ourselves how Payability works and if it had true value to the average seller.

#1 Fees Are of Gross Sales Not Payout

This is the biggest complaint I found and the one that actually concerned me enough to really dig deeper here as opposed to just continuing to not promote it myself.

The biggest complaint is that the fees are removed from your gross sales BEFORE fees, returns, and chargebacks and NOT from a percentage of your payout.

#2 A Secret Background Check

I'm not going to fault Payability for performing a background check when deciding who to approve, BUT I see why it might conflict with their sales point of "No Credit Checks."

I won't hold this against Payability, but I think they should consider making it clearer, as many people would like to know before they consent to a background check.

#3 Insult to Injury If You're Suspended

What stinks more than getting suspended on Amazon? Getting hit with fees from Payability when you don't have access to your payouts. This was something that I hadn't even considered before starting my research. How would Payability handle getting their fee from your payouts if there aren't any payouts?

Long story short, this fellow was suspended unfairly (the high velocity sales review is unfair) and then got introduced to one of Payability's lesser known weapons of extraction: the roll-over balance fee.

"

I wish that was the case, but Amazon suspends sellers unfairly every single day. In fact, I don't know many sellers who have been on the platform for 5 years or more who HAVEN'T been suspended. Many of the examples are glitches in the system or wild overreactions to minor infractions.

Now, I'd be less bothered by this if I felt sellers were suspended for their own mistakes, but that's just not always the case. Good sellers will get hit extra hard if they happened to also have Payability when they're unfairly struck by fate.

#4 Confusing Reports

Multiple people complained that the reports were difficult to understand, and that this was done intentionally.

I actually have to disagree with this. Having seen the reports, they seem to be as clear as possible given the complexity of the lending process.

#5 Confusing Contract

Payability is far from the only guilty party here. This has long been a major pet-peeve of mine in the financial lending space.

The documents read more like terms of a peace treaty to end an intergalactic war than any sort of two party buyer and lender agreement.

For example, here's the Instant Advance Terms and Conditions.

After reading about a 1/4 of the way through, I found my eyes getting glossy. I decided for fun to copy and paste the text into the tool I use to measure the readability of my own content.

Here are the results...

The document is not only incredibly long (8,600 words), but it is also written in a way that would be best fit for college graduates. That's not normal anywhere beyond the financial lending space.

For contrast, I try to keep all my writing on this website below an 8th grade reading level.

While this type of writing isn't uncommon in the lending space, it's also unnecessary.

These contracts are 99% for the lender's benefit and protection. You reading and understanding them is a nice bonus. The only real negative for them is a few angry reviews when people inevitably overlook something.

#6 "Risk Free Trial" Isn't Free

Several reviews complained that they were charged fees after cancelling their Instant Access account during the 7 day trial period.

In fairness to Payability, they don't say that it is free of fees, just free of risk. I do agree that this is somewhat misleading, but Payability does explain this during the enrollment process.

(More of a bait and switch where you have the chance to change your mind before agreeing than some sort of malicious con job.)

It's reasonable that they can't just give advances with no fees to hedge their risks.

It might be worth removing this option all together.

#7 Vanishing Funds in Instant Advance

I was skeptical when I heard stories of people claiming they had money just disappearing, but everyone I've spoken to has told me that Payability's support team acknowledged there are known glitches that cause over payments.

Due to the unique nature of the Instant Advance, it's not shocking that some glitches are happening. Be sure to closely monitor your account if you do use Payability.

"Why Are They Getting So Much Public Praise If There Are So Many People with Issues?"

Now, I wouldn't have spent an ounce of time and energy on this article if I felt the public was already getting a fair depiction of the service.

I had a really difficult time wrapping my head around the stark contrast between what I was seeing from influencers and large review sites like Trust Pilot about Payability and what I was seeing with my own eyes in the seller communities.

The TrustPilot Conflict

I run a Facebook group called FBA Today that has over 50,000 members at the time of this writing.

There have been more than a few posts in there from people asking directly about Payability or just general questions about getting their payouts more quickly.

Time after time, there was more negative things said about Payability than positive ones (I'll share those shortly).

I had to really dig deep to find any positive feedback at all.

That is, except on Trustpilot...where they have a very impressive 4.5 star average over 294 reviews.

Now, TrustPilot is far from an accurate representation of people's real feelings about products and services. It's ironically, one of the least trustworthy ways you could possibly get reviews on anything. Trust Pilot has become a "pay to play" service that has dramatically watered down the legitimacy of their results, using tactics such as "review gating" that make it easier to reach out to users who were most likely to have a positive experience. For example, you could choose to email users who have used your service for 3+ years or had purchased multiple times.

But, this article isn't intended to be a roast of Trust Pilot. We can save that for another day maybe 🙂

But anyway, based on the organic feedback I've seen about Payability, that is my guess about what happened here.

The stark contrast here was just too much for me to ignore. I don't feel like sellers are getting a truly honest view of the program, so, I decided to make one.

The Payability Affiliate Program Conflict

I'm an unapologetic affiliate marketer. I'm

They have a very compelling affiliate program, and I looked into them as a potential affiliate partner. A lot of the people in my space promoted them, and the concept on paper was sound.

More capital to use = More profit potential.

It seemed like a perfect fit for my readers...or it seemed so until I did my research.

It didn't pass the review process, and I couldn't join their affiliate army with a clean conscience. Forgive my virtue signaling...I would be a huge promoter of it if I believed it was in your best interest, and I'd gladly take the commissions for it!

Let's move on.

The Defense of Payability

My goal isn't to trash Payability, it's to inform my readers as best as I can. So, it's important that I make the case for Payability as

Defense #1 No Actual Fraud

Unless you know something I don't, Payability is playing by the rules. We can argue about changing the rules, but I haven't seen any evidence to support the fact that they are genuinely stealing or committing actual fraud of any kind.

If I claimed that Payability was guilty of any sort of crimes, I could easily be sued for slander.

If things change, I'll update this post accordingly, but they seem to understand how to play by the book, as sketchy as it seems.

Defense #2 Inevitable Negativity in Lending

Look, the average person isn't exactly Warren Buffett in terms of financial literacy, myself included. Don't let this post fool you into thinking I know everything.

It shouldn't be a surprise to see that they have angered a lot of people while working with a lot of people.

Defense #3 Even with High Fees and Headaches, You Can Make It Work

As I said at the beginning, the concept is sound. Even with the high fees and various headaches, many sellers will and do leverage Payability to effectively scale more quickly.

Payability Alternatives

I'll repeat this: I absolutely support sellers who want to leverage debt to scale.

However, this isn't a bait and switch post where I bash one product in order to sell you another. There really isn't a perfect Payability alternative that I can recommend in terms of daily payout advances.

I do suggest the following options for generating cashflow to scale your business more quickly.

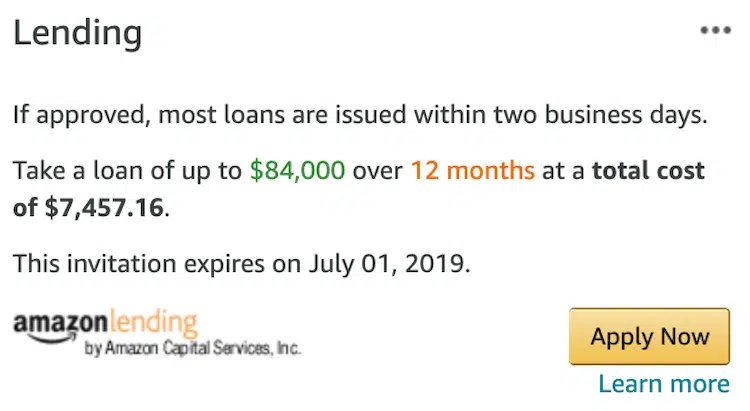

#1 Amazon Loans

Although you can't control when these are offered, I always recommend that sellers take Amazon up on these loans if cash flow is an issue. The terms are fair, and this can be a game changer during the fourth quarter.

You can learn more about Amazon lending here.

#2 Cash Back Credit Cards

Credit cards get a bad reputation. In the world of e-commerce, they can be an extremely valuable tool if leveraged properly.

Using credit cards for scaling your business is so far away from using credit cards to buy a PS5 when your bank account is at $12, and you don't want to wait.

Entrepreneurship isn't without risk, and leveraging credit cards can be a hugely rewarding risk to take if you handle it properly.

Here's a recent thread in our Facebook group that covers the different credit cards that our members are using.

#3 Supplier Financing

If you're a wholesale or private label seller, you can always see if your supplier will give you longer payment terms, so you can get an inventory order in before you actually get your Amazon payout.

If you've been a loyal customer, they might be open to negotiating. Of course, be sure that you're confident that you can repay on time, so you don't burn bridges and lose your supply sources.

The Bottom Line

After my own deep dive, I've concluded that Payability isn't as great as the TrustPilot reviews claim, but it also isn't as awful as some of the vague negative feedback in my Facebook group claims.

Although there are better options with more reasonable fees, it is certainly possible to leverage Payability to scale your business.

It might be worth considering Payability if the following are all met....

- Cashflow is an issue

- You have immediate opportunities for high profit, fast moving inventory

- You're financially literate and understand the terms

- Your account is in good standing, and a suspension isn't imminent

- You've already utilized the Payability alternatives I mentioned above

- You're willing to closely monitor your reports for errors

Don't jump onto Payability or any similar advance services just because you're impatient for your next payout. Only leverage it if there is a clear opportunity for growth, and the opportunity cost of not taking the capital is extremely high.